- In The Snow Newsletter | by Jonathan Snow

- Posts

- My 10 Predictions for Ecommerce in 2026 🔮

My 10 Predictions for Ecommerce in 2026 🔮

10 Bold Predictions for DTC & Performance Marketing

2025 is Coming to a Close!

ANOTHER year in the books.

Overall, the year was mostly in line with my expectations. Super strong Q1-Q3, but Q4 disappointed slightly in terms of efficiency (not spend levels). Overall, the year met expectations.

Before we dive in to 2026 and what I think it has in store for us, lets see how my 2025 predictions fared…

How My 2025 Predictions Fared 👇

(ties indicated by 🤔; ties awarded when trend is in the direction of my prediction, but not fully played out yet)

1. Meta remains king (spend, performance, NC acq) ✅

2. Biggest share of wallet gainer: AppLovin ✅

3. AppLovin performance remains steady DESPITE rise in auction competition (offset by algo/feature strengthening) ✅

4. Explosion of new, viable performance channels for DTC brands.. more than ever before. ✅

👀 Chase Media Solutions, Shop Cash, Nift, Unity/Liftoff

5. Further washing out/devaluing of the "button clicking" channel marketer. This is commoditized. ✅

More emphasis on "comprehensive marketer" which straddles all channels, requires expertise/understanding of each level of funnel & data/tech/creative.

6. Shop Cash begins to drive meaningful scale for adopters. 🤔

7. Meta prioritizes VALUE & 1P data sharing to strengthen performance. Sharing info back to Meta that it doesn't already have becomes the norm to make algo smarter. ✅

8. Snapchat resurgence: once again seen as a viable, yet scale-limited, performance channel. ✅

9. Snap launches native checkout on "Snap Stores" & goes after TikTok Shop. ❌

10. Meta reprioritizes social commerce & adds the "Shop" tab back to IG. ❌

11. Influencer/Affiliate/Seeding programs & strategies converge. ✅

12. Meta's Health & Wellness data policy update is more a cat & mouse game than death sentence to impacted brands. HMU if you need help here ASAP. ✅

13. AI-driven activation of 1P data like never before. We'll see dynamic, hyper-personalized websites/LPs based on a user's audience segment/history w/ the brand/traffic source etc. ❌

14. AI UGC is actually usable. Lots of policy/governance will arise from it to ensure FTC compliance. ✅

15. AI agents will be deployed by brands to help increase AOV & LTV, shorten time to next purchase, and achieve other brand objectives of their choosing. ❌

16. DTC data nerds become as valuable as (if not more than) the marketer. 🤔

17. Influence for Equity. Top brands bring on influencers as equity partners at scale that will vest based on deliverables and performance. ✅

18. Trump rescues TikTok & does NOT have to be sold to a US company. Trump brokers a deal that allows ByteDance to retain control but only if XYZ conditions are met, all of which are highly favorable to the US. 🤔

19. Consumer sentiment/confidence returns to 2021 highs. ❌

20. Brands have a return to growth mindset. Top & bottom line matter equally. If it means sacrificing/risking bottom for top line, that is OK. ✅

21. Consolidation in the tech & agency spaces. ✅

22. Top of funnel/brand budgets skew more towards IRL events & activations to get in front of their desired demos. 🤔

23. Brands figure out how to measure IRL data & activate it digitally. 🤔

24. Large institutions seeking revenue growth will activate their audiences & 1P data more readily to DTC brands. ✅

25. Brands prioritize enriching 1P data w/ customer social media handles (arguably more important than email/sms!) 🤔

BONUS PREDICTION

📈 BIGGEST gainer stock (ecom sector): $APP ✅

not financial advice

2025 Record: 15-5-6

Not bad. Now onto 2026…

10 Predictions for Ecommerce in 2026

#1 - AI Creative is Not Just Usable… it’s Scalable

For those who still claim AI creative is “trash” and “slop”… they just don’t know what tools are available or how to use them.

We’ve been scaling both video and image AI creative on every channel (Meta, TikTok, AppLovin, Snap) successfully for over a month now.

Not through any ad platform’s native tools though (those are still trash), but through a combination of third party AI creative tools.

Marketing has become a game of systematizing tools and signals. And calibrating it to business performance.

The black box ad platforms were supposed to make media buying easier, but in fact it’s muddied the waters and pushed marketers & creatives into uncharted territories.

Those who know how to use the tools efficiently and at scale are the ones who will thrive. Marketers and creatives are one and the same right now. The lines have never been more blurred.

This has been a major focus of mine for the last 6 months and it’s paying off.

#2 - TikTok Shop GMV Growth in the US ACCELERATES

Many talking heads claimed social commerce was a fad that would fade into the abyss. They couldn’t have been more wrong.

I’ve been bullish on TikTok Shop since Day 1. Thankfully we made this a priority since the early days. We’re not left scrambling to figure it all out now out of necessity (like many brands and agencies). I saw the writing on the wall. Getting UGC at a super low cost, super high volume, and 10x more efficient than traditional influencer UGC was extremely attractive. Creating momentum & brand awareness for the cost of product samples was always a no brainer to me. Using that content as a creative testing ground to unlock new investable creators and reach new audiences is something that you could only do on TikTok Shop.

Here’s how TikTok Shop in the US has fared over the last few years:

2024 ~$9B

2025 ~$16B (projected)… 78% growth

What does 2026 have in store?

I’m going to make a BOLD prediction and estimate that it hits $30B in GMV in the US in 2026. Brands are really coming around to TikTok Shop now and have accepted that it’s a place they need to be present on… or risk having their competitors steal market share there.

Here are some well-known brands that launched on TikTok Shop in 2025:

QVC, Meta, Shark, Ninja, Crocs, JBL… just to name a few.

I’m expecting even more big names in 2026.

#3 - Meta Rips TikTok Shop

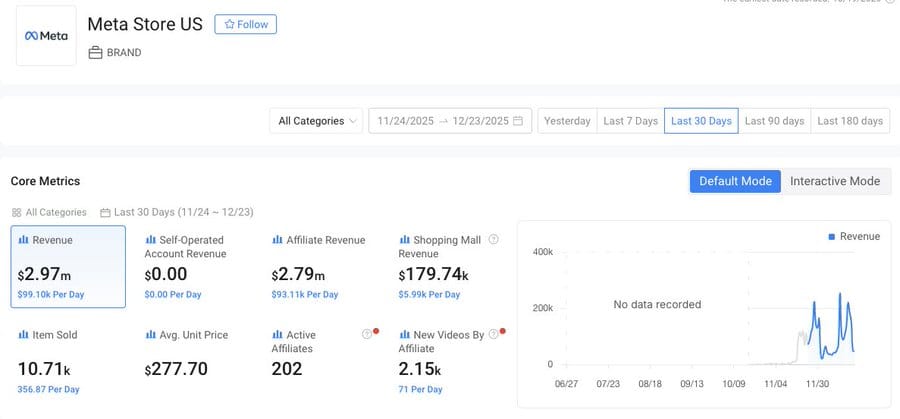

Meta (yes, $META ( ▼ 1.55% ) ) quietly launched on TikTok Shop this past month. Curious move.

In the L30 days, they've done $3M in TTS revenue. Nearly all GMV through affiliates. They're now a Top 50 seller on the platform.

What's even more interesting...

They have 5x more ads live on TIKTOK right now than on their own platform (Meta). Meta isn't just going through the motions, they are going ALL in on TikTok Shop.

So, one of these 2 scenarios is in play:

1. Meta is just reverse engineering the entire affiliate/Shop ecosystem for its ultimate relaunch of social commerce.

2. Meta finds value in selling its consumer products on TikTok Shop.

Let’s be real… Meta doesn’t need TikTok to sell its products, its own ad platform is far more powerful.

AND there’s no better copier than Zuck. Over the years, Meta’s best products were virtual copies of other platforms: Reels, Stories, Threads, and Live.

Shop is next! Mark my word.

#4 - Top Share of Wallet Gainer: AppLovin (…again)

Another talking heads topic. The talking heads, short sellers, every Negative Nancy in between… wrong in 2025.

“AppLovin is a scam.”

“AppLovin is run by Chinese spies.”

“AppLovin just steals Meta’s homework.”

Yadda yadda.

My prediction a year ago came just before the mainstream madness ensued when $APP ( ▲ 6.44% ) launched it's ecom beta…

The stock has 5x’ed since then… mostly due to its successful venture into ecom ads.

In 2025, according to Northbeam, AppLovin was the 3rd highest spend channel for ecom brands (after Meta and Google), eclipsing YouTube, TikTok, Snap, Reddit, Pinterest… by orders of magnitude.

And it’s still in closed beta! Invite only.

The platform is far from perfect, but traction like this can’t be ignored.

I feel like they’re just getting warmed up and they have a super sharp, hungry team that UNDERSTANDS performance marketing. I have extreme faith in them evolving the platform to everyone’s benefit.

And so, I’m predicting that it once again takes the crown for biggest share of wallet gainer… in 2026. Somewhere in the ballpark of 5-8% (will be using numbers reported by Northbeam).

#5 - Traditional Pay-for-Post/UGC Influencer Model is DEAD

Creative Volume. Creative Diversity.

The two most important phrases of 2026.

Not just for Meta. For all AI/ML-driven ad platforms.

Traditional UGC model has been this for the past few years:

pay for the piece of UGC w/ usage rights, pay for whitelisting access, do this with a couple dozen influencers per month, have the influencers follow this overly engineered creative brief, take weeks to deliver a finished piece of content. Each piece of UGC comes out to $1k when you consider your own human resources to manage this.

This model does not achieve creative efficient volume or diversity. It is simply not aligned with Meta (and other platforms’) business objectives.

Enter affiliate influencers (via TikTok Shop).

Here’s how it works:

pay for UGC only when the creative leads to an attributable sale, get usage rights for free, get whitelisting access for free, have affiliate influencers loosely follow a creative brief, do this with hundreds if not thousands of influencers per month, and automate most of it.

TikTok Shop is THE most cost effective and efficient solution to achieve both creative volume and diversity.

We’ve 4x’ed brands SHOPIFY revenue in under a year purely thanks to TikTok Shop affiliate content that we amplified across channels.

THIS IS THE PLAYBOOK!

#6 - Snap Continues its Rise 📈

$SNAP ( ▲ 0.21% ) has been quietly crushing for us.

In 2025, it became a meaningful part of our media mix. All thanks to 2 meaningful updates Snap made to its ad platform.

7DC0DV Optimization

Target Cost bidding

Prior to these 2 things, I had conviction Snap did not drive any real measurable performance. Things have changed.

The platform should continue to get better.

Leverage your TikTok Shop affiliate content, launch it on Snap. Thank me later.

#7 - Meta’s AI Agents Fuel Incremental Performance Gains

Meta just bought Manus for ~$2B and planning to incorporate it into its consumer AND business units.

On the business front, expect Meta to leverage Manus tech to create AI agents for its advertisers both on and off platform... throughout the ENTIRE FUNNEL.

Meta already has on-site agents in motion for advertisers (few actually know this). These agents are designed not just to help convert users on brands' sites, but also to gather all of this off-platform signal & send it back to the pixel to inform the algo. Meta has been strong. It's going to get even stronger.

Meta’s Manus-driven agents will indisputably help fuel further performance gains for brands through direct attributable revenue & through 0-party signal enhancement.

Imagine the AI agent on site helping customers with nuanced personal questions such as “is this ok to eat if you have a peanut allergy?” or “what’s the best outfit for my annual ski vacation?”. Meta will gobble up any/all information users submit to its agents and use that to enrich your user profile (not just on the brand’s targeting, but on that user’s targeting on the platform for all brands).

#8 - Consumer Sentiment Rebounds to Highest Level Since 2021

2025 was a BRUTAL year for the consumer.

Inflation, high interest rates, debt, loan defaults, job market weakness….all bad.

As such, the Consumer Sentiment Index reached its LOWEST level since 2022 in November 2025, ringing in at 51.0.

My prediction is that we will see a massive surge and break the 80.0 level in 2026 at some point. All thanks to a softening Fed policy w/ expected declines in interest rates, cooling inflation, and potential stimulus programs looming.

This would be very good news for $SHOP ( ▲ 1.84% ) .

#9 - Organic Social Becomes a Performance Channel

Thanks to the current trajectory of AI creative, I am predicting that organic social (namely IG, FB, and TT) becomes a real performance channel in 2026.

The things we’re seeing with AI creative right now have me very hopeful we’ll have a fully automated system to publish hundreds of creatives daily to brand, persona, and blog style organic social handles. Lets do some simple math…

If we publish 100 creatives organically per day… if each averages 100 impressions, that’s 10k impressions per day… 30 days per month puts us at 300k organic impressions at virtually $0 cost. If we ramp it to 300 creatives per day, now we’re talking something in the ballpark of 1m organic impressions per month.

Inevitably, 1-5% of them will outperform by a standard deviation and we’ll decide to put ad spend behind them.

AI creative will serve us as both an organic upper funnel channel and automated creative pipeline generator.

AI simply fuels performance everywhere.

#10 - Performance Product Sampling Scales to IRL/Events

TikTok Shop product sampling took the world by storm over the past few years.

It’s more of a ‘cast a wide net’ volume approach, which is great.

But what if you could sample products out to people in the exact niche you’re looking to target?

Enter IRL events.

Testing a really interesting new event/IRL sampling platform that I have high hopes for.

Integrating offline/IRL with online/digital will be the real challenge.

Will be reporting on performance & impact in 2026. BULLISH.

That’s a wrap!

Wishing you all a very….

🎉 HAPPY NEW YEAR 🎉

May you have a blessed 2026, may it be your best year yet!!

What I’m Listening to 🎧

Beats of the Week: MoBlack at GIZA Pyramids for Zamna

Ooooh this was a good one. Giza Pyramids backdrop, unique middle eastern infused beats. Vibes on vibes. Give this one a listen, but probably better viewing on the big screen while sitting on the couch with a beverage in hand.

You’re reading In The Snow, by Jonathan Snow.

This is where operators, media buyers, and digital execs stay ahead of the curve.

Feel free to reply directly with any thoughts or feedback.

Reply